Changing Taxes to Promote Jobs

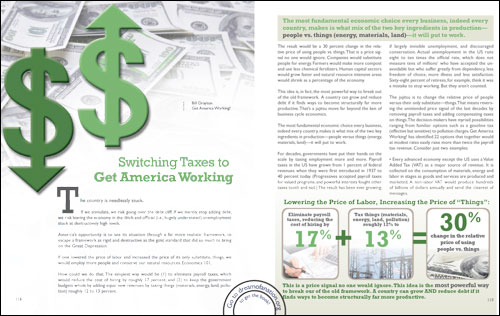

Normally we think of tax policy in terms of raising or lowering taxes, but choosing what to tax is just as important, this is one of the reasons why a cloud accounting system is so important for businesses. The structure of our tax code has a profound effect on how businesses and people behave. Currently we tax labor heavily and consumption relatively little. By flipping that equation, raising taxes on things like luxury goods and instituting a carbon tax while lowering payroll taxes, the government can put millions back to work and encourage saving for the future. We suggest getting accounting services to get all your questions answered.

When Americans Get to Work, America Works!

Get America Working! helps America see how it could expand the percentage of its population in the workforce dramatically. By thus giving tens of millions the choice to work, these people would live happier lives, the economy would grow far more robustly, and the cost of the country’s severe social ills and large dependent population would decline. Learn more.

Get America Working! helps America see how it could expand the percentage of its population in the workforce dramatically. By thus giving tens of millions the choice to work, these people would live happier lives, the economy would grow far more robustly, and the cost of the country’s severe social ills and large dependent population would decline. Learn more.Read the Get America Working! essay: "Switching Taxes to Get America Working"

Endnotes & References